Business people generally believe that satisfying customers is a good thing, but they don’t necessarily understand the link between satisfaction and profits. This is partly because much of the original work was done so long ago that contradictory cases and nuances have allowed confusion to build up. Additionally, some companies have appeared successful for a time despite poor satisfaction, generally in industries where there is limited or no competition such as airlines.

But even here there are shining examples; Southwest Airlines leads other airlines in satisfaction and, not coincidentally, has been profitable for 36 straight years – despite the turmoil of the economy and fuel prices.

In case you need more convincing, there are plenty of published studies showing the link between customer satisfaction and financial performance. The Burke Institute, a leading national market and customer training organization, created and studies the Secure Customer Index methodology that is described in the rest of this post.

Benefits from satisfied customers

Each industry is slightly different, but there are some consistent principles:

- Satisfied customers tend to continue to buy from the same company. They are easier to market and sell to (for repeat purchases, increased usage or cross selling).

- It costs much less to retain existing customers than to acquire new ones.

- Satisfied customers tell others about their positive experiences, while dissatisfied customers tell even more people about their negative experience.

Why conduct customer satisfaction research

The current economic conditions make customer satisfaction even more important. But don’t make the mistake of thinking that research can only tell you what’s happened in the past. Sure, the report-card aspect has some value, but the real power comes from insights that help provide guidance for the future.

Research can tell you which customers are really satisfied, and why. Remember, most of your customers are silent. The outspoken customer is generally not typical, and satisfying the squeaky wheel may not be helpful overall, in fact, it may be counterproductive. What if you enhance your offerings to support a customer whose hot buttons aren’t similar to your good customers? What happens if layoffs force you to concentrate on fewer customers? Learning what you should do to better support good customers is generally the best approach.

What should you measure?

The three high-level measures you should use are Overall Satisfaction, Likelihood of Future Purchase, and Likelihood to Recommend. The wording may vary with your situation, but the concepts remain constant. These three measures allow you to measure the current situation, to predict retention (loyalty), and to balance marketing and other costs against the value of customer groups.

Can’t I just use the Net Promoter Score?

I don’t want to get into a debate about Net Promoter. You’ll find plenty of discussion on the methodology online if you are interested in the controversy. Suffice it to say that I don’t accept the premise that the NPS is the one number you need (as Frederick Reichheld stated) for powerful customer satisfaction research. If you want to calculate the Net Promoter Score you can do that from data you already collect; the Likelihood to Recommend question is the same and the results can be used in different ways.

How do you analyze?

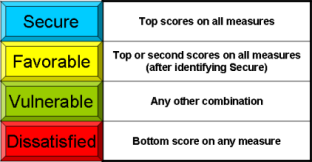

Combining the results from the three high-level satisfaction measures allows you to understand how each customer is classified. You’ll need to decide how to code the responses. A common approach for 5 point scales is to only count a score of 5 for the most satisfied, and so on.

The percentage classified as Secure is known as the Secure Customer Index.

Secure customers are those who are most satisfied overall, most likely to repurchase, and most likely to recommend (scoring top on all three questions). These are the most valuable customers overall – because they buy the most, are the best advocates, and generally cost less to service. They probably won’t need expensive changes to remain classified as secure, but it is important that the company continues to provide appropriate support to keep them in the category. For the example study in the article, this group was 88% likely to remain a customer after 1 year, and 33% were likely to increase purchases. These are only example results, and economic effects will move these numbers, but the difference between secure and other customers is likely to remain.

Favorable customers are generally well satisfied, scoring top or second for all the three questions. Improvements are often directed at this category because they are the easiest to move to the secure category where they become even more valuable. In the example study, this group was 57% likely to remain a customer, and 20% likely to increase purchasing.

The Vulnerable group is those who have middle of the road scores on all measures. This group is not usually as important to target as others, in part because the impact of changes is not as assured. Over time, the percentage of customers in this group should be minimized.

The Dissatisfied group is comprised of those customers who score low on any of the three satisfaction measures. It is often tempting to focus energy on making changes that improve perceptions by this group, but this may not pay off. Rather, learning the causes of the dissatisfaction will help the company to avoid seeking more customers who may also be dissatisfied for the same reasons when there are no immediate fixes. For example a customer who is driven by low prices is probably not a desirable customer for a company seeking to differentiate through added services. Better targeting should minimize the size of this group.

Taking action

Once the customers are classified, you can profile them to understand what makes them different and take appropriate action.

- Are the secure customers less likely to be using a product that has some problems? Perhaps it has some bugs, or perhaps competitors have a better solution. It would be a good idea to address those issues before marketing the flawed product heavily, or you might risk losing the goodwill of your best customers.

- Are some customers less satisfied because they have run into customer service or support issues? Maybe those lower satisfaction levels can be traced to specific customer-facing personnel who need training.

- Can you identify combinations of products or services that are used by more satisfied customers? Cross-selling these combinations will likely yield good results, not only for immediate revenue, but also to increase loyalty.

Extending the research

The above analysis can be done with the three satisfaction questions combined with demographics and other profile questions.

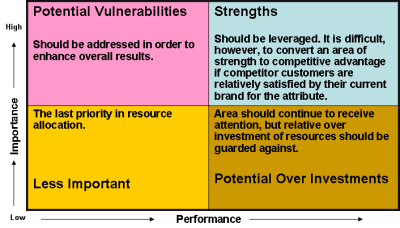

To take the research to another level you can include detailed questions about customers’ perceptions of importance and performance of specific attributes and features. Analysis of these importance/performance questions is useful standalone, but can also be combined with the higher level satisfaction questions and the classification to provide deeper insights.

- Which groups of customers value specific features, and which desire improvements? If your dissatisfied customers are the only ones who are complaining about a particular issue, perhaps fixing it will cost too much. It is generally better to focus on enhancements that are appreciated by customers who are already favorable, although you should pay attention to competition too.

- What do customers really think is important versus what they tell you? Customers may tell you that they want a lower price, but is that really going to pay off? Even today, most people aren’t buying purely on price. Think of your own purchasing behavior and motivations. Would you switch to a different chiropractor or car mechanic just because someone else is offering lower prices? Conversely, will you buy more ice-cream because the price is lower (maybe, in my case).

The point is that you shouldn’t just lower prices reactively. Sophisticated analysis may be needed to tease out all the information in your data, but you can learn quite a lot from a simple importance-performance matrix.

Now is a great time to get started with customer satisfaction research.

Idiosyncratically,

Mike Pritchard

Hello!

Very Interesting post! Thank you for such interesting resource!

PS: Sorry for my bad english, I’v just started to learn this language 😉

See you!

Your, Raiul Baztepo

I’m glad you found the article useful Raiul. Your English is fine, no need to apologize.

Mike Pritchard